Analyzing Exchange Token Risk with Serenity Post-FTX12

by Kyle Downey, CEO & Co-founder - 19 Nov 2022

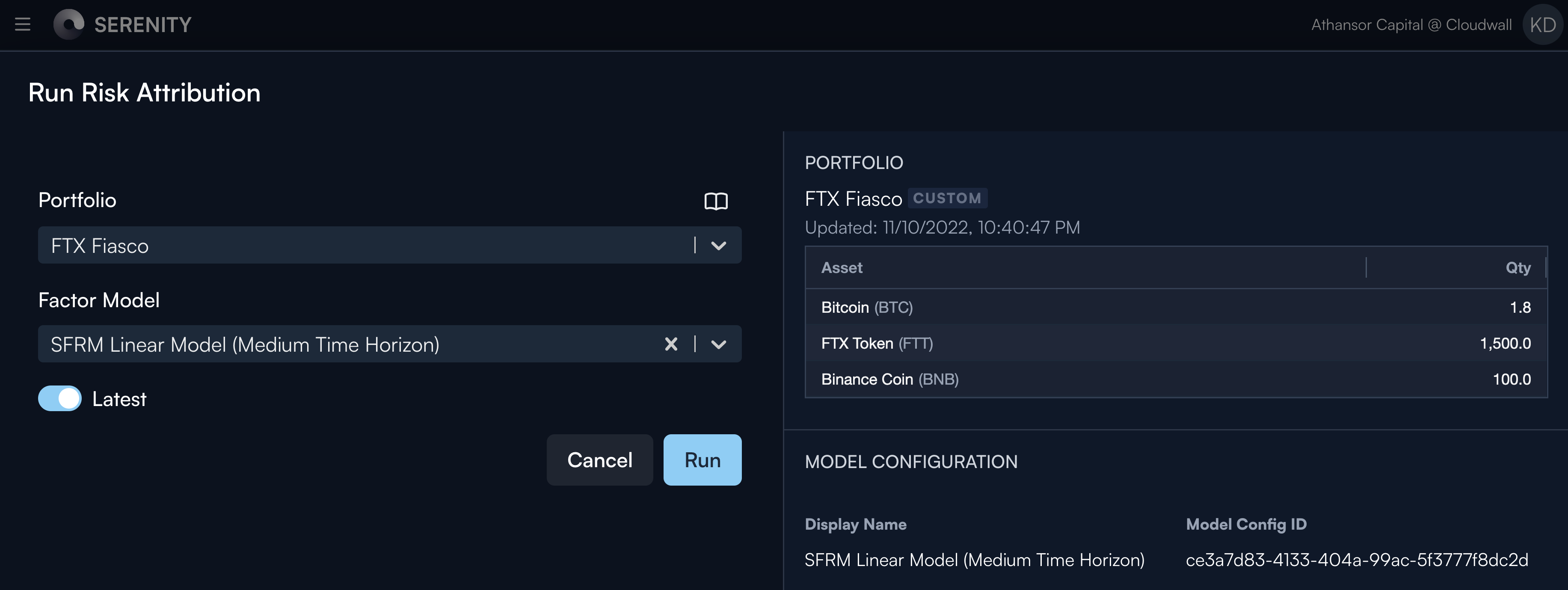

After the FTX bankruptcy we decided to take a look at a simple, equally-balanced portfolio of FTT-BNB-BTC on November 7th, and see how its risk evaluation shifted post-bankruptcy.

With Serenity you can manually create or upload a portfolio, then choose a model to run it against, so we start with that basic FTT-BNB-BTC portfolio:

The output shows you the portfolio risk, the constituent factor loads and matrices, and the breakdown of the risk by asset, sector and factor. As we chose token quantities to achieve roughly equal weights, you can see the risk is roughly equally balanced in absolute, relative and marginal terms, which means pre-crisis there was little warning:

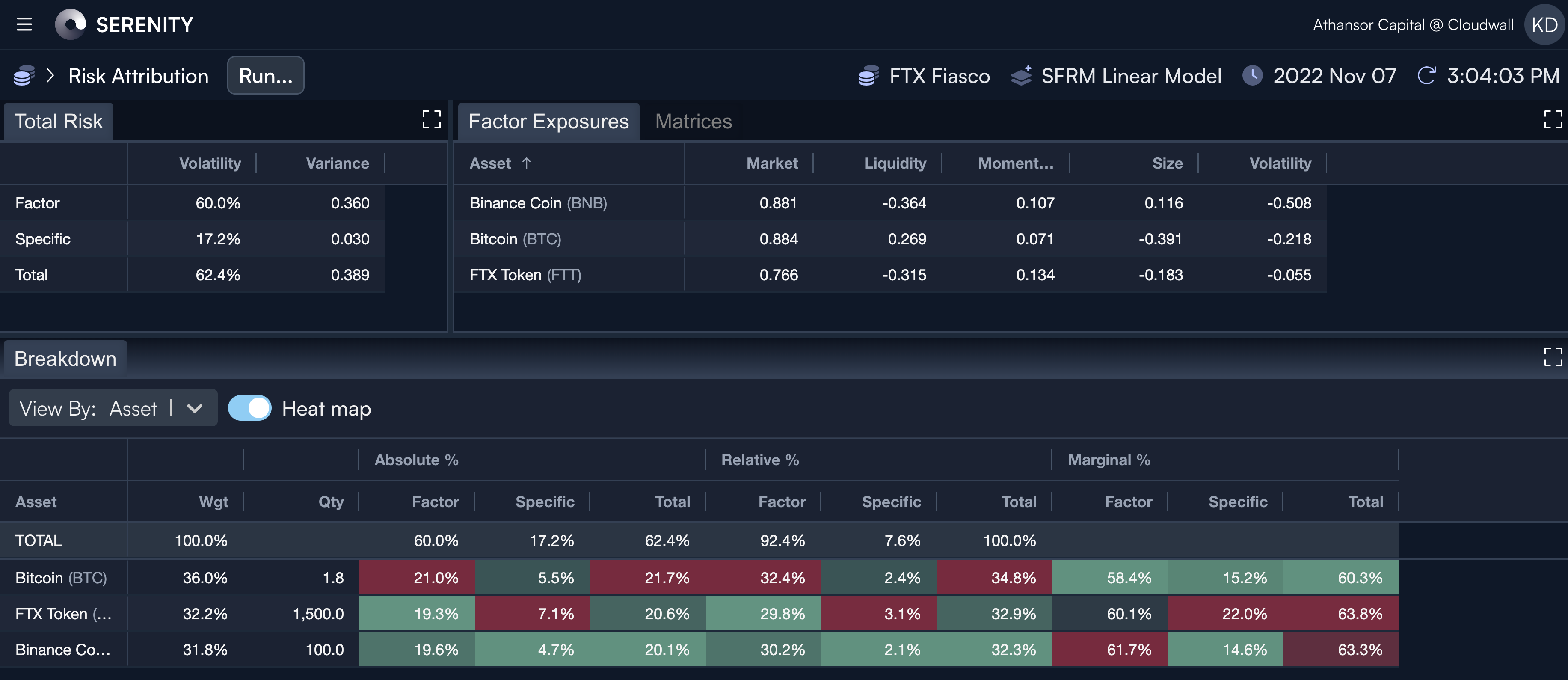

Post-bankruptcy, the portfolio's FTT position is now a very small part of the risk due to the collapse in prices and thus weight, but you can see the sensitivity (marginal risk %) has spiked to more than double previously:

This is an important thing to understand: a risk system is not a crystal ball. It helps you understand the portfolio concentrations sensitivities and thus can inform choices about rebalances and hedges, but for a tail risk event like the FTX collapse it is unlikely to provide early warning. Put another way: Serenity can help improve resilience, but not avoid all harm.

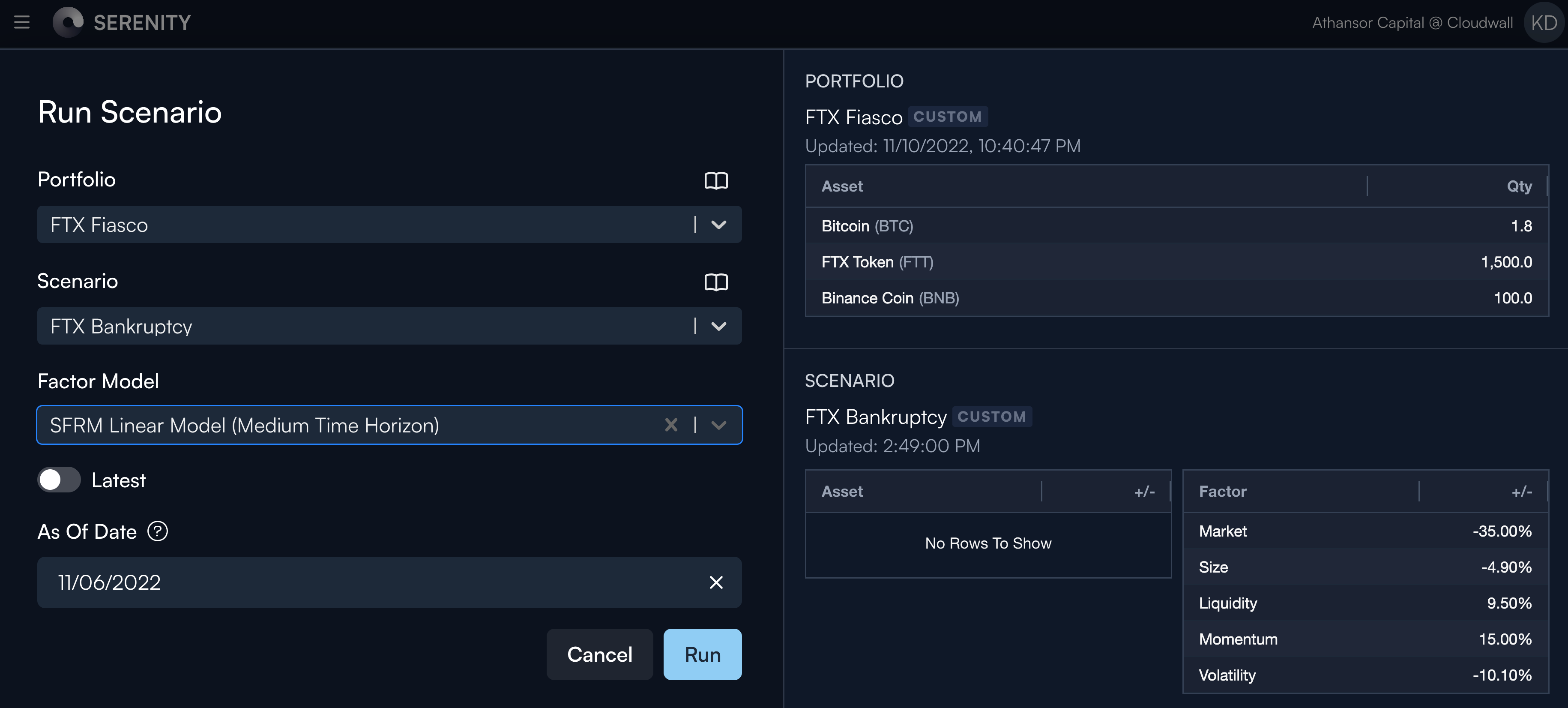

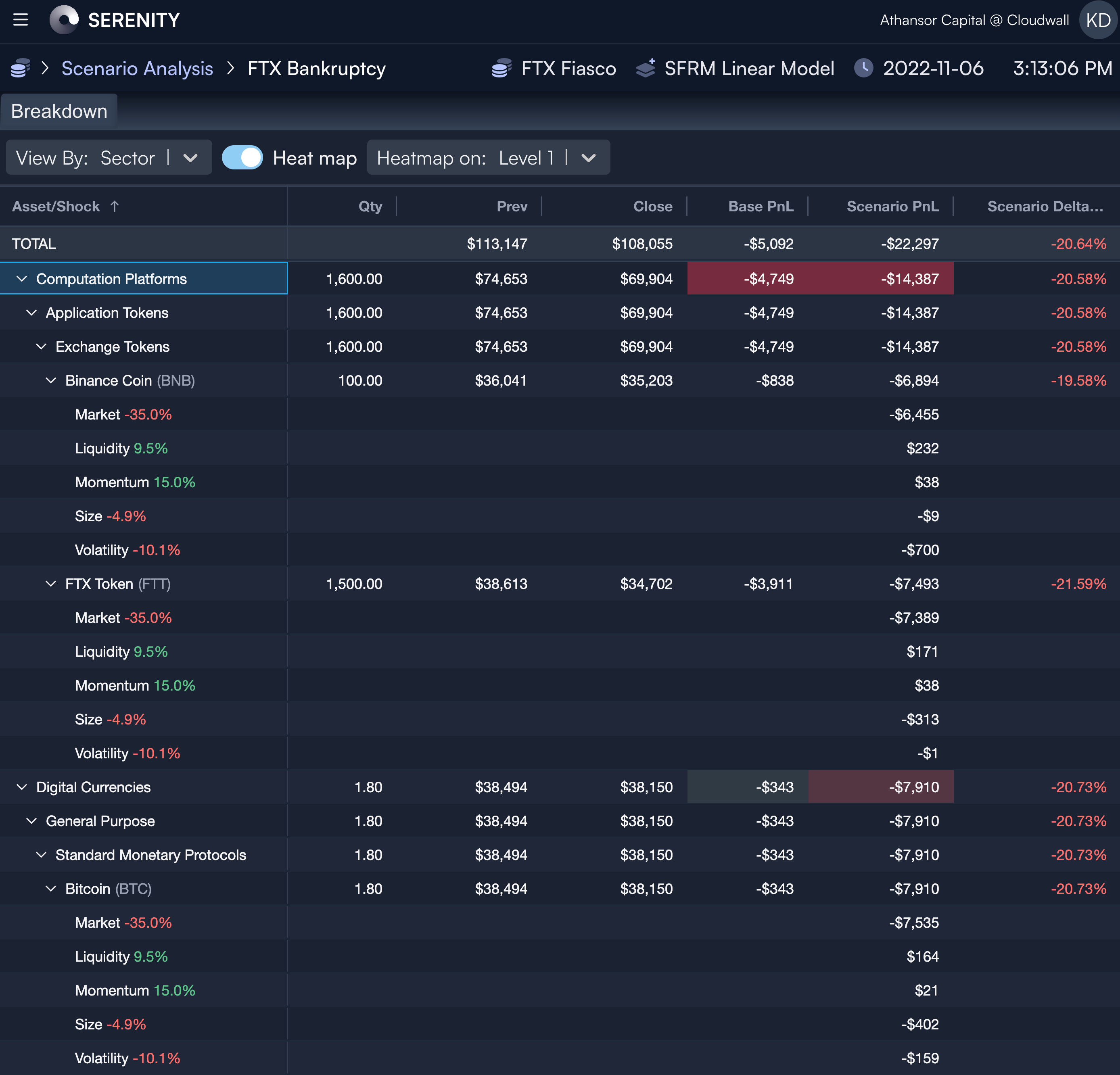

But what if we had asked ourselves the week before what might happen in such an event? Serenity contains canned scenarios from past crashes to let you ask such what-if scenarios. By taking advantage of the factor risk model, it can see how the crash would play out. To do such a run we start by defining the scenario in factor shocks; as the event is still ongoing we fitted returns from 6 November until 18 November, then pick our portfolio and the model to use:

The differential impact on different factors hints at the values of diversification even in the face of a major tail risk event. The impact on our mini-portfolio, while not realistic in terms of the specific FTT impact, is nevertheless less than you might expect from the size of the market crash alone -- this is due to those positive factor loadings, where some parts of the market responded more positively:

Interested? Reach out to get access, and learn how you can use Serenity to better understand your portfolio's digital asset risks. Trade with conviction.